Even if it has cloud written all over it, software is only seldom truly provided as a service. This is the core finding of a recent study by PwC.

“Cloud washing (also spelled cloudwashing) is the purposeful and sometimes deceptive attempt by a vendor to rebrand an old product or service by associating the buzzword ‘cloud’ with it,”

wrote Margaret Rouse in August 2011. Since then a whole load of dirty cloud laundry has been through the wash. The fact remains in 2016 that software is very seldom actually offered, provided and used in the cloud delivery model.

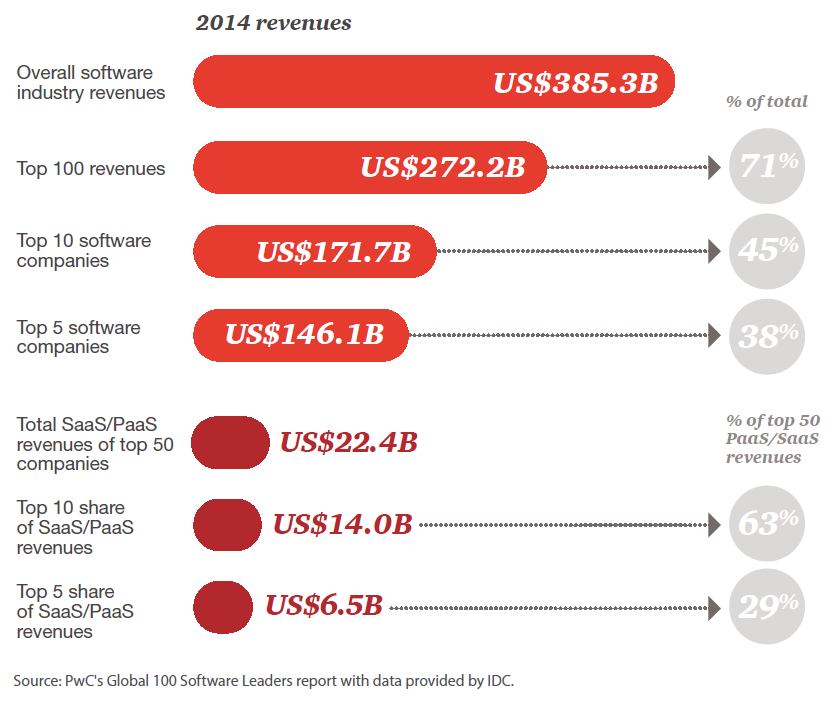

PwC has just published its study titled “PwC Global 100 Software Leaders”. Amongst the top ten software producers ranked by turnover, only one – Salesforce – exclusively offers software and platform as a service (SaaS, PaaS). Aggregating the revenue that the nine other providers earned from SaaS and PaaS shows that they only constitute a single figure proportion of their total software earnings. For the three largest – Microsoft, Oracle and IBM – it adds up to a mere four percent.

The cloud proportion of turnover is still rather marginal

The figures which underpin the study are from the end of 2014, as “GeekWire“ noted in a summary. “I think the broad trends we identified are continuing today,” says Raman Chitkara, PwC’s global technology industry leader.

Other service providers that the PwC study considers to have a noteworthy SaaS or PaaS presence include Intuit (46 percent), Adobe Systems (23 percent), Cisco Systems (35 percent), Citrix (27 percent) and naturally Google (85 percent). In the top 50 there was no other company making 100 percent of its turnover from SaaS or PaaS, only ADP came anywhere close with 93 percent. On average the 50 largest software companies earned twelve percent of their turnover from the cloud.

A more common numbers game moreover shows that the ten biggest software companies together achieve 45 percent of the total earnings – the software revenues of Microsoft, Oracle, IBM, SAP, Symantec, EMC, VMware, HP, Salesforce and Intuit add up to $171.7 million, while PwC values the total global software market at $385.3 million. What’s more, all of the software giants apart from SAP are headquartered in the US. The full study is available as a PDF download from PwC.

US giants dominant in Europe too

On the topic of US domination, it is well worth taking a quick look at today’s online Wall Street Journal. There one can read that the market for public cloud infrastructure in Europe is dominated mainly by four American companies – Amazon, Microsoft (this duo are also leading the latest magic quadrant for IaaS according to Gartner), Google and IBM. Together, in 2015, they attained a 40 percent share of the market according to a count conducted by market researchers at IDC, after nearly tripling their turnover in the region within three years. European providers “only” managed to grow by 86 percent over the same period.

This shows that the US cloud giants have suffered less from Edward Snowdon’s revelations than many observers had expected. European rivals, on the other hand, have not understood how to sustainably capitalize on the temporary loss of trust.

And the US enterprises have countered all their efforts with significantly higher investment, including data centers, on the European continent – and are now harvesting the fruits of their superior scalability. “In the end it comes down to the size, operating efficiency and automation at these big players,” says Jack Sepple, Senior Managing Director of Cloud Computing at consultants Accenture. “Local providers can hardly be expected to keep up.”

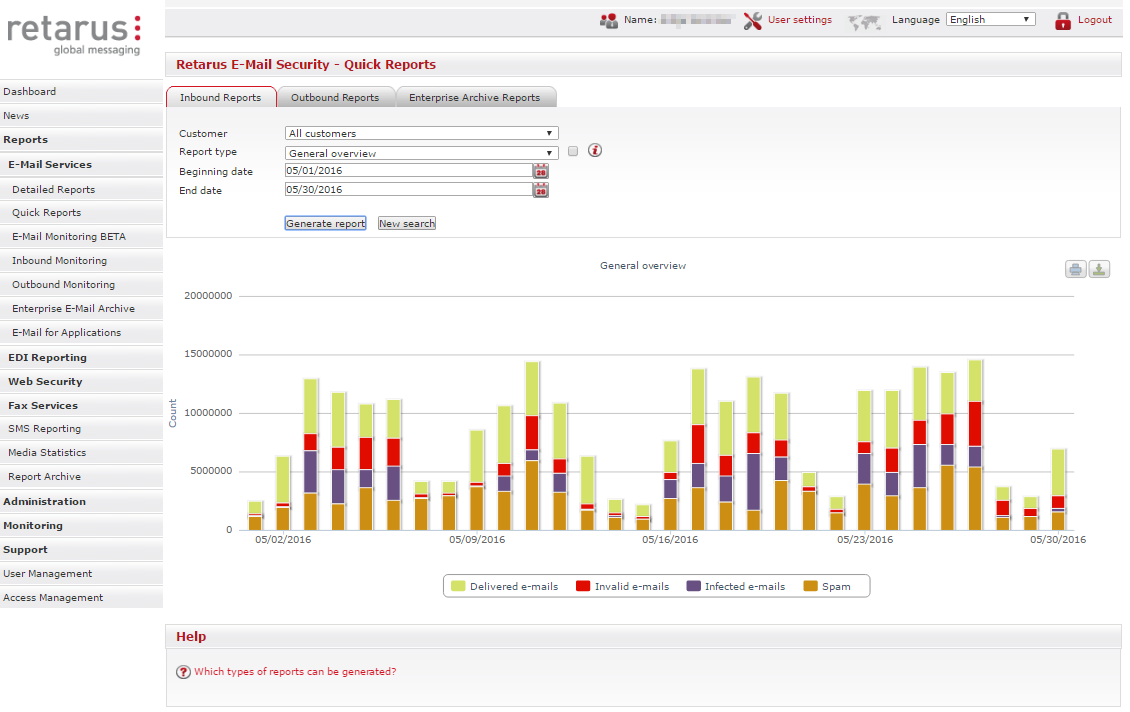

You can best judge for yourself how much cloud there is in Retarus’ managed and shared services: our multi-tenant software developed in-house is running on our own hardware in our own data centers in Germany and around the world. Customers do not need to install any software or hardware and only pay for the services actually performed for them in a pay-per-use billing model. Find out more about Retarus Cloud Services here or directly from your local Retarus contact person.