France already implemented the EU’s E-Invoicing Directive for B2G back in 2017. Since January 1st, 2020, those regulations have also been legally binding in the country and have proven an unconditional success. Around 140 million invoices have already been issued to public sector organizations and government administrations by way of the officially prescribed platform, Chorus Pro.

From July 1st, 2024, mandatory e-invoicing and e-reporting regulations will also come into force for business-to-business (B2B) commerce. The most important provisions in Ordonnance n° 2021-1190 and Ordonnance n° 2014-697 can be outlined as follows:

- Regardless of their size, companies must be able to receive invoices in an electronic form from July 1st, 2024, if their suppliers have a duty to issue electronic invoices.

- Compulsory e-invoicing and e-reporting provisions will be introduced in three phases, depending on the size of the company (the current size definitions can be found on the website of the French E-Invoicing Association):

- On July 1st, 2024, for large businesses,

- by January 1st, 2025, for medium-sized businesses, and

- by January 1st, 2026, for all businesses.

- E-invoicing requirements:

- Compulsory electronic invoicing for domestic B2B transactions, which boils down to e-invoicing for all business activity between companies subject to tax.

- E-reporting requirements:

- Duty for companies to electronically report sales made to consumers (B2C), international B2B transactions, intra-EU deliveries as well as transaction details for invoices or sales for which the tax point (date of VAT register) is the date of payment.

To sum up: All companies in France must be able to receive invoices in electronic form as of July 2024 and have the capability to issue electronic invoices by January 2026. The duty to report also extends to foreign companies which are subject to and collect VAT in France.

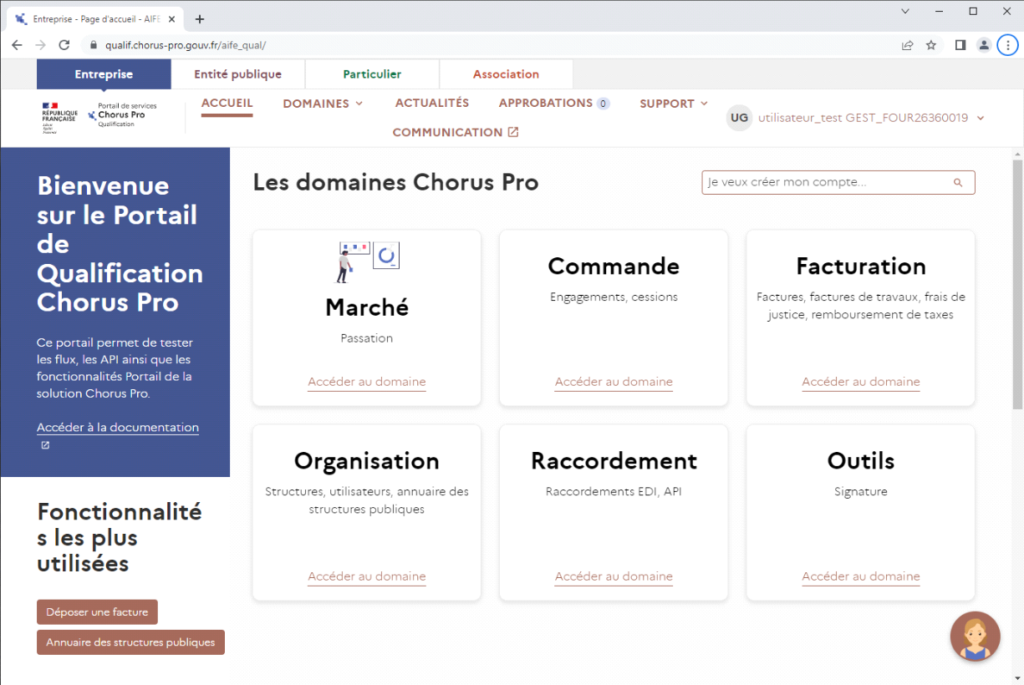

Chorus Pro and private sector alternatives

For dealings with public organizations and government authorities in France, companies basically have two options. Either they can use an authorized platform offered by a third-party provider (partner dematerialization platform, PDP for short), or the government’s official portal, Chorus Pro, and manage the transmission of the required information themselves.

Chorus Pro is the centralized portal for the administration of electronic invoicing in the public sector. In France, it’s the one and only interface which can be used to address all authorities and government administrations in the country using conventional, tried-and-tested EDI channels and formats. The platform is provided free of charge to suppliers and public sector customers. However, it requires expert familiarity with public sector administration processes in France and up-to-date knowledge about the continuously changing requirements and stipulations of the tax authorities – not to mention mastering the French language.

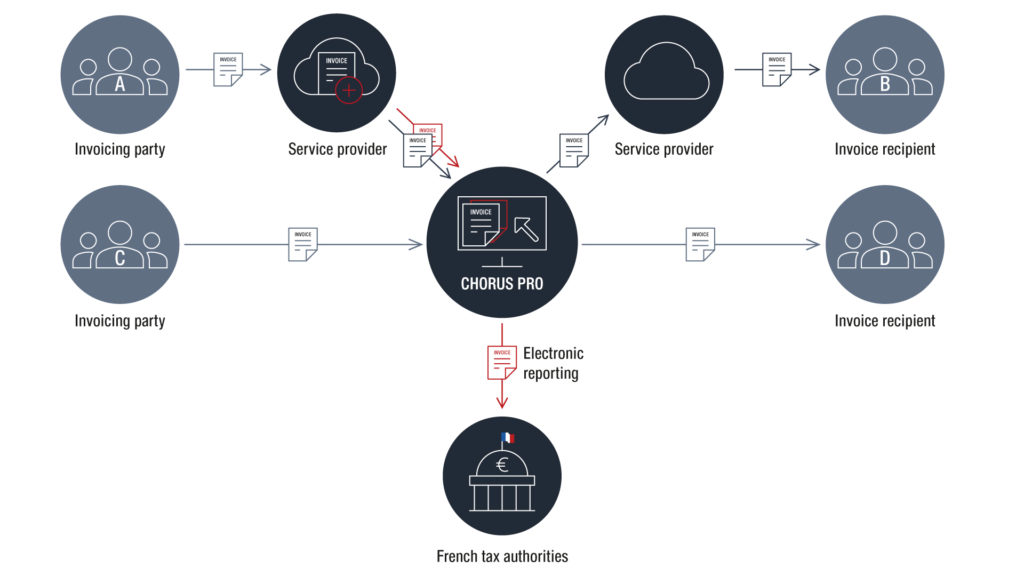

The freedom for users to choose the platform and channels they would prefer to employ – known here as the Y concept – provides certain benefits, such as the option of selecting a suitable service provider, using existing structures efficiently, maintaining flexibility and tailoring solutions to meet the company’s needs more precisely.

With the new laws coming into force in France, companies will no longer be permitted to send invoices directly to their B2B customers.

From 2024, companies will have two options for sending electronic invoices and meeting their reporting duties in the B2B sector. Identically to the B2G requirements, they will be able to use the services of a third-party provider (PDP) for electronic invoicing and reporting. In this case, the third-party provider has two distinct tasks – it’s responsible both for transmitting the e-invoice to the customer and passing on the prescribed information to the French tax authorities. In this case, the partner uses its own cloud solution to feed the information into Chorus Pro, the national e-invoice management platform. A second option would be to use the official invoicing portal (Portail Public de Facturation, PPF for short) to transmit invoices and reports directly, and then set up the connection with Chorus Pro themselves as required.

When selecting a partner platform, it’s also crucial that companies bear in mind their mandatory archiving commitments and consider whether they are reliant on sending and receiving invoices from international suppliers (PEPPOL connection). In our previous blog post on e-invoicing, we put together some useful tips for choosing a suitable service provider.

To sum up: In B2G and soon also in B2B commerce, companies in France have the choice of either connecting independently and directly to the official government platform or using an appropriately certified third-party platform. In either case, the company has to ensure it meets a range of duties and commitments regarding the transmission of the invoices and details to customers and the tax authorities, as well as complying with the legal and tax requirements for archiving invoices.

Formats for sending electronic invoices in France

Basically, every electronic invoice in the EU has to fulfill the B2G e-invoicing standard EN16931. In France, three formats have already been agreed upon, which are also accepted in various hybrid versions:

Currently (July 2022), a readable PDF file still needs to be transmitted along with the data. To ensure interoperability, third party platforms usually support all three formats. The government platform Chorus Pro is based on CII and Factur-X.

A solution for all requirements and communication channels

Retarus E-Invoicing is a cost-efficient cloud solution, developed with EDI DNA and more than 27 years’ experience. It complies with international regulations and meets the highly diverse technical requirements in different countries. As a certified PEPPOL Access Point and member of several local e-invoicing associations, Retarus offers its customers legally compliant e-invoicing for B2G, B2B and B2C in Europe and around the globe, always in compliance with international standards.

Find out more about Retarus E-Invoicing on our website or directly from your local Retarus representative.