At Retarus, we do not only offer our customers cloud and managed EDI services, but also the appropriate, convenient archiving options.

The archiving of documents as required by locally applicable tax laws is always strictly regulated, for instance in Germany by the GoBD (“Principles for properly maintaining and storing books, records and documents in electronic form and for data access”).

Referring to EDI data, the guideline states: “When converting documents for mandatory archiving into a company-specific format (i.e. an in-house format), it is required that both versions be archived, be allocated the same record ID and administrated by means of the same index, while the converted version has to be clearly marked as such.” This means that both the original and converted documents have to be archived – especially if the EDI files represent a record which is relevant for tax purposes. It is not permitted, for instance, to export the EDI data as a PDF and then use this file as the tax record while declaring the EDI data only as a posting aid to avoid having to archive it.

It also makes the following statement about scanned documents which are converted into EDI data: “Following the scanning procedure all further processing must only be done using the electronic document. […] To the extent that the paper document (hard copy) has to be processed further for administrative purposes following the scanning procedure, it is required that after processing has been completed the altered paper document must once again be scanned and that a reference needs to be made to the original document (common index).” Here too, each revised version of the document has to be archived.

In the course of an audit potential shortcomings in these processes may become apparent, leading to unpleasant consequences. If you are interested in finding out more details, please take a look at this presentation from the Verband elektronische Rechnung (Association for Electronic Invoicing), of which Retarus is a member.

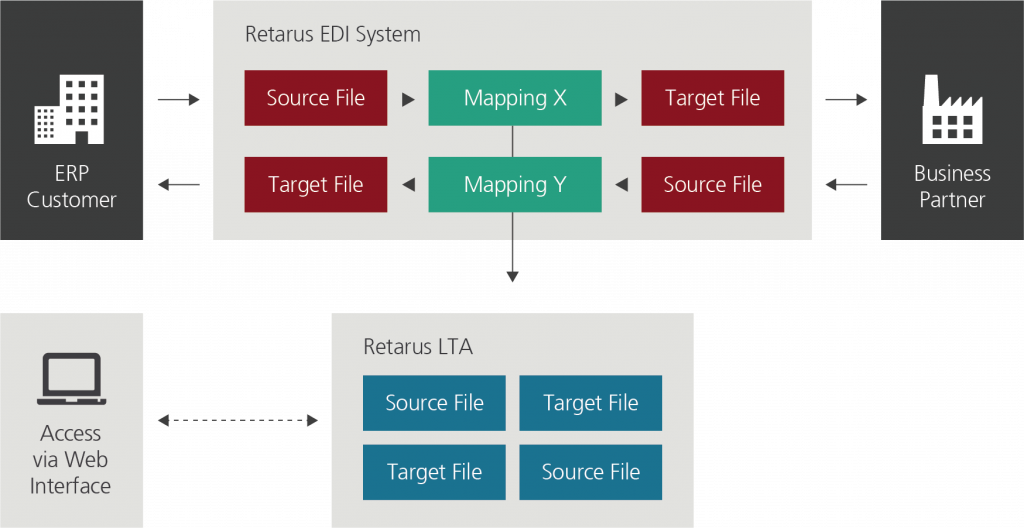

Retarus offers its EDI customers two archiving options, which can be combined with each other. If the customer would like to undertake their own archiving, we can transfer the original and converted documents back separately. Alternatively, we can also provide our customers with a long-term archive, especially for invoices (EDI / PDF), which offers comprehensive functionality and ensures legally compliant archiving (including GoBD) for over 50 countries across the globe.

We also offer supplementary functions for Italy or Hungary, where tax-relevant document are subject to a “preservation process” following the archiving period, to verify the integrity of the data over the entire archiving period. To ensure this a check sum with metadata is written into a separate XML file for each archived file. This file is subsequently marked with a digital time stamp, after which it is stored in the archive from where it can be retrieved as required.

Customers are provided with a dedicated web portal, which allows them to access and search for archived data. The highly granular user administration (SuperAdmin, Admin, User, Audit) facilitates external online audits; while at the same time an event log registers each and every login, access and download. The storage of data takes place in accordance with European data privacy guidelines. The Retarus EDI Long Time Archiving service can easily be integrated into existing IT environments. The costs are calculable, based on usage. De-provisioning is naturally also possible, meaning that every risk can be excluded. You can find more information about our EDI services here or from your local Retarus contact person.