For Customers, Suppliers, Public Authorities and Platforms

There is hardly a business process today that is undergoing as many changes as invoicing. More and more, established invoicing processes involve the most varied transmission channels, formats and media types. Invoicing requirements, which now also include those of other countries, are so complex that existing systems and infrastructures frequently reach their limits.

Retarus Integration and Automation Services help you to fulfill almost all requirements that apply to sending or receiving e-invoices in no time at all. And Retarus supports that invoicing processes you use for both your customers and suppliers. We also work together with public authorities across Europe as well as platforms such as Peppol, Ariba, Chorus Pro, Sistema di Interscambio (SdI), Online Számla and many more.

Our Services

Comprehensive support

Support for hybrid formats

Processing of all channels

Comprehensive solution

Customized support (SLAs )

Complex process handling

Automatic data capture

References from Numerous Industries

- Automotive

- Manufacturing industry

- Pharma & healthcare

- Food industry

- Wholesale and retail

- Logistics

Manage All of Your Invoice Process Requirements Centrally

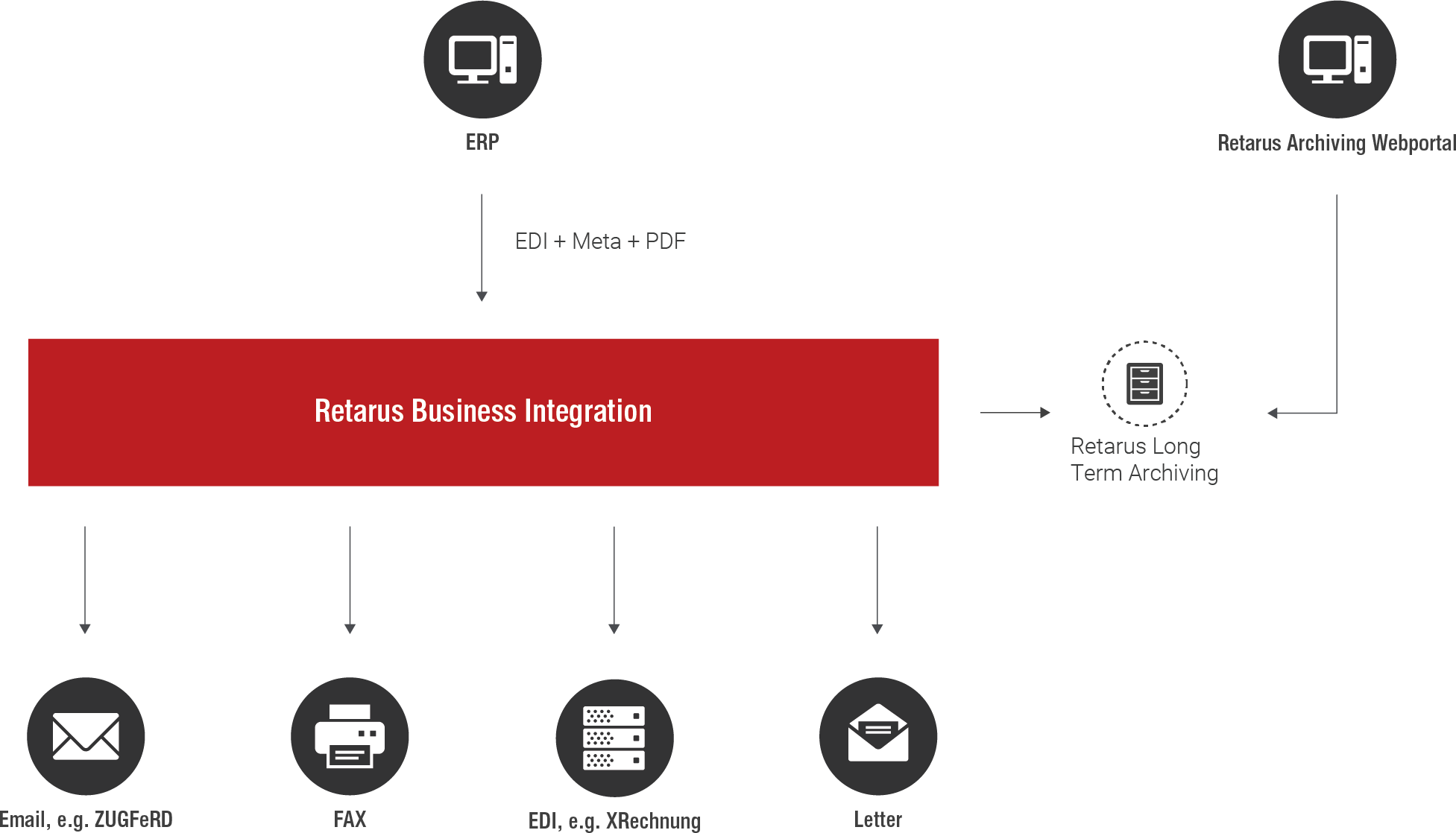

Outbound

Retarus supports your invoicing via all of today’s conventional communication channels. Each month, we send millions of invoices for our customers. Thanks to hybrid formats that combine PDF and structured invoicing data, you can set simple EDI parameters to define the outgoing channel.

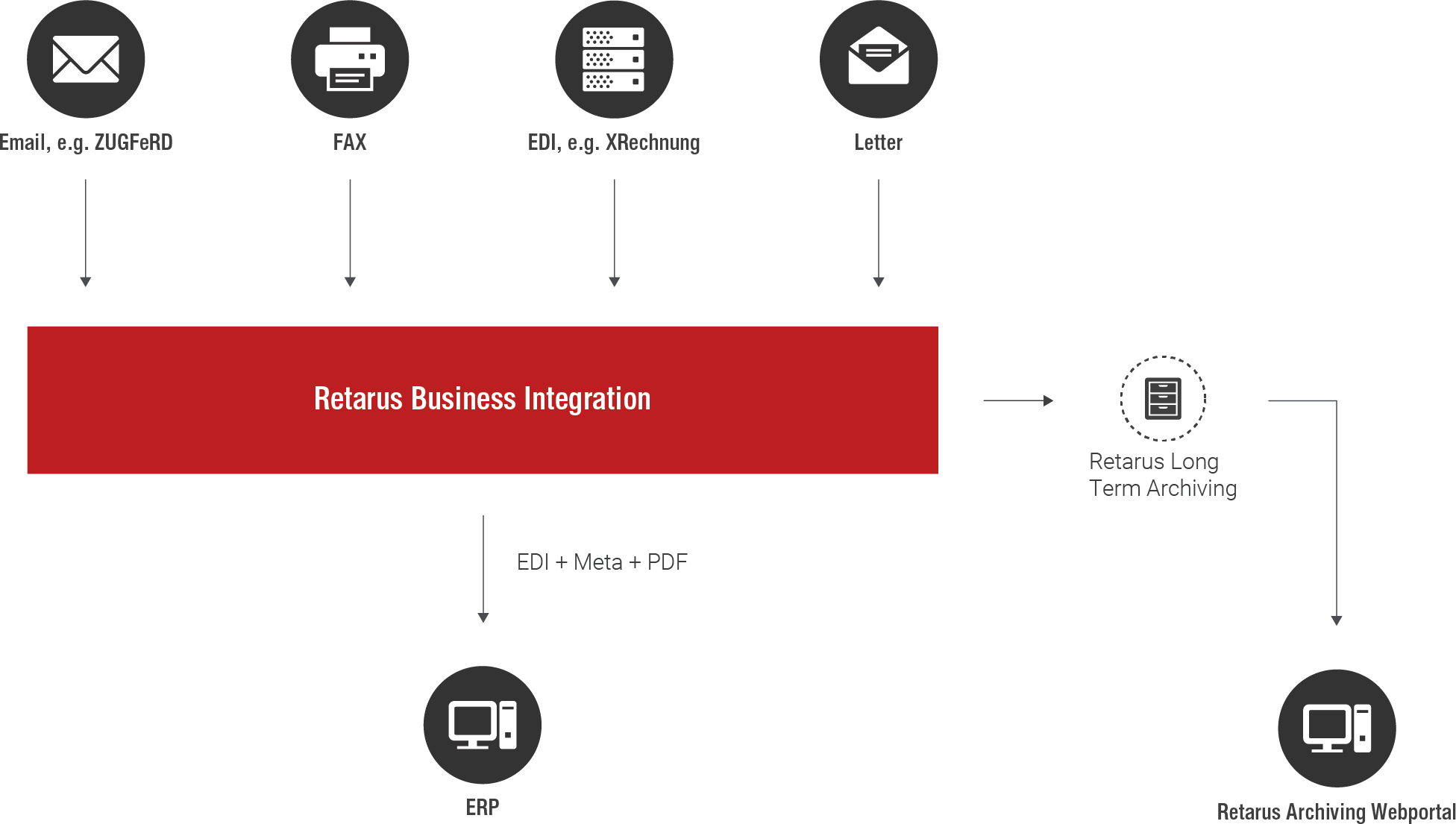

Inbound

Invoices are sent through the most varied channels that are often very difficult to manage. Simple PDF documents are not very useful in this case, because even though they are “digital” and cost-effective, they cannot be processed in a structured or automatic way. Retarus can work with all of your input channels and capture unstructured documents in such a way that you always receive structured documents in the end.

Your Advantage with Retarus

Document validation

Retarus document validation helps you save an enormous amount of time otherwise spent on checking details and correcting errors.

Long-term archiving according to GoBD guidelines

You no longer need to keep pace with ever-changing compliance requirements. This means you are always up to date when something changes.

Electronic signature

With Retarus’ Signing Service, PDFs and selected EDI formats receive a qualified electronic signature and therefore comply with external or internal e-Invoicing compliance requirements.

What should an e-Invoicing solution provider be able to offer?

Retarus allows you to concentrate on your core business and rely on the many years of expertise and high-end services of a specialized, third-party provider for your electronic invoicing.

Peppol: Retarus Connects You to Europe’s Public Authorities

Let Retarus Help You Become a Part of the Network

Joining the Peppol network is easy with Retarus. The only thing we need from you is your invoice data in any format via any communication protocol. Our EDI team will handle the rest with our Cloud EDI Integration.

Saving Time and Money in B2B Communication with Peppol

Companies are well advised to opt for a Peppol Access Point or service provider which supports receiving messages in addition to sending them. In principle, companies can communicate by way of Peppol with all partners who are also connected to the network by way of a service provider. As hardly any new operational costs are incurred, customers save time and effort for implementation – the more partners, the more appreciably – as well as cutting costs.

Peppol Can Do so Much More Than Just B2G

Many companies remain unaware of the enormous potential Peppol has in the B2B sphere. This is largely due to Peppol thus far only marketing itself as a B2G standard. Service providers, on the other hand, have long been pointing to the potential savings it offers as a B2B solution. In principle, companies can communicate by way of Peppol with all partners who are also connected to the network by way of one of the many service providers.

Benefits of Peppol at a Glance

- Automation of the B2G invoicing process

- Encrypted and confirmed transfer

- Meets the requirements of the entire purchase-to-pay process chain

- International coverage

- Can be used as a B2B network

- Covers B2B communications along the supply chain

Peppol: Connecting with the Public Sector in Europe and Worldwide

All you need to know to easily send e-invoices to the public sector throughout Europe can be found in this white paper.

E-Invoicing Specifics in Europe

The EU Commission has been taking steps to advance the adoption of electronic invoicing for quite some time now, and the free market has also long taken note of the benefits e-Invoicing offers to processes. However, e-Invoicing in Europe is currently evolving so dynamically that one could easily lose track of developments. Most member states have introduced their own standards that need to be complied with when invoicing, such as:

Mandatory Electronic Invoicing for B2G Transactions in Germany

Anyone in Germany who wants to issue invoices to federal, state and local authorities must do so electronically. PDF invoices are no longer permitted for this. Instead, data must be transferred in the form of an XRechnung.

Another buzzword in e-Invoicing is ZUGFeRD 2.1.1, which is a hybrid format. In addition to a PDF document, the ZUGFeRD format also includes a structured, standard-compliant XML file. ZUGFeRD is particularly suited for sending bulk invoices. In the past, invoices were sent as simple PDF files, which often complicated things for recipients when they tried to capture the data.

Retarus Integration and Automation Services offer the entire range of e-Invoicing solutions and infrastructure required for B2G, B2B & B2C through to long-term archiving. And finally, the human factor with excellent service and support makes all the difference.

Everything You Need To Know About Electronic Invoicing in Germany: XRechnung and ZUGFeRD 2.0

Want to learn more about the story behind the XRechnung and ZUGFeRD formats, why there is no way around them and how you can start using them? Then read the Retarus white paper.

More Partnerships / Memberships:

Mandatory Electronic Invoicing for B2G Transactions in France

France already implemented the EU’s E-Invoicing Directive for B2G back in 2017. Since January 1st, 2020, those regulations have also been legally binding in the country and have proven an unconditional success. Around 140 million invoices have already been issued to public sector organizations and government administrations by way of the officially prescribed platform, Chorus Pro.

Mandatory Electronic Invoicing for B2B Transactions in France

As of July 2024, mandatory e-Invoicing and e-reporting regulations will also come into force for B2B commerce. The duty to report also extends to foreign companies which are subject to and collect VAT in France.

Retarus ensures the transmission of electronic invoices and the forwarding of mandatory data to the French tax authorities, as well as legally and fiscally compliant archiving.

Mandatory e-invoicing for B2B in France from 2024

Learn all about the new e-Invoicing regulations in France, the government portal Chorus Pro and private alternatives, as well as the French e-Invoicing clearance model.

Mandatory Electronic Invoicing for B2B Transactions in Italy

As of January 1, 2019, Italy has been obliging its companies to issue all invoices electronically conforming with FatturaPA and send them via the official document interchange platform Sistema di Interscambio (SdI).

This regulation applies to all local companies with a VAT (Value Tax) ID number, including the Italian subsidiaries of international enterprises as well as all suppliers and service providers registered in Italy which send invoices to Italian customers. Invoices sent by means other than SdI will not be considered valid invoices – with all the consequences that fact entails.

The invoices must be transmitted in FatturaPA XML format, bearing a qualified digital signature. In addition to this, wide-ranging, country-specific requirements need to be considered with regard to archiving.

Smaller companies have the option of entering or downloading the data for a small number of invoices by means of a web portal or PEC. Larger companies, on the other hand, will not be able to get around connecting their ERP systems directly with SdI to automatically process their FatturaPA invoices and any responses that may arise.

Retarus can take these connection efforts off your hands completely. Among many other benefits, our Integration and Automation Services cover FatturaPA conversion, the signature process as well as long-term archiving.

Mandatory Electronic Invoicing for B2B and B2C Transactions in Hungary

Already in mid-2018, Hungary intensified the duty to report invoices online. From this date onwards, all those liable for taxation under the Hungarian tax authority were required to report all software-generated invoices made out to any other party also subject to Hungarian taxation, provided that the invoice included value tax of at least 100,000 forint. The transmission of these reports had to be done in an electronic and automated manner via the online invoicing system Online Számla using the pre-defined XML data format OSA XML.

Hungary Accelerates E-Invoicing (XML Version 3.0)

Learn more about the changes in detail, what the new XML version 3.0 is all about and how Retarus can support you in providing compliant electronic invoices to Hungarian companies.

With Retarus’ Integration and Automation Services, implementing the complex connection in Hungary can be achieved in quick time. We not only support the more detailed XML wrapper format OSA XML but are even able to check your data in advance if you so require. This significantly reduces the efforts you expend on correction work.

Retarus’ E-Invoicing Solutions are not dependent on the ERP system you are using or your business context (B2G, B2B or B2C). Our cost-efficient cloud solutions offer you security in implementing high-performance e-Invoicing processes on the global stage. Retarus covers national and international standards (such as XRechnung, ZUGFeRD, Factur-X, UBL, CII, FatturaPA, OSA XML, and many more) and ensures that the formats are always in line with the latest regulations. In addition, we offer our customers the option of convenient long-term archiving for their digital invoices.

Fully Satisfied Customers

Many companies around the world already trust in Retarus. Select your industry and find out who is already benefiting from our Integration and Automation Services:

We Are Here to Support You.

Do you have questions? Would you like more information about Retarus’ Integration and Automation Services? We would be glad to hear from you. Call or send us an email. We’re also happy to stop by and demonstrate our solutions to you.